International Seminar

日本語 → 10th SAAJ International Seminar

| 16 April 2019

| Tokyo, Japan

Sponsored by SAAJ

Archive 2018

Report

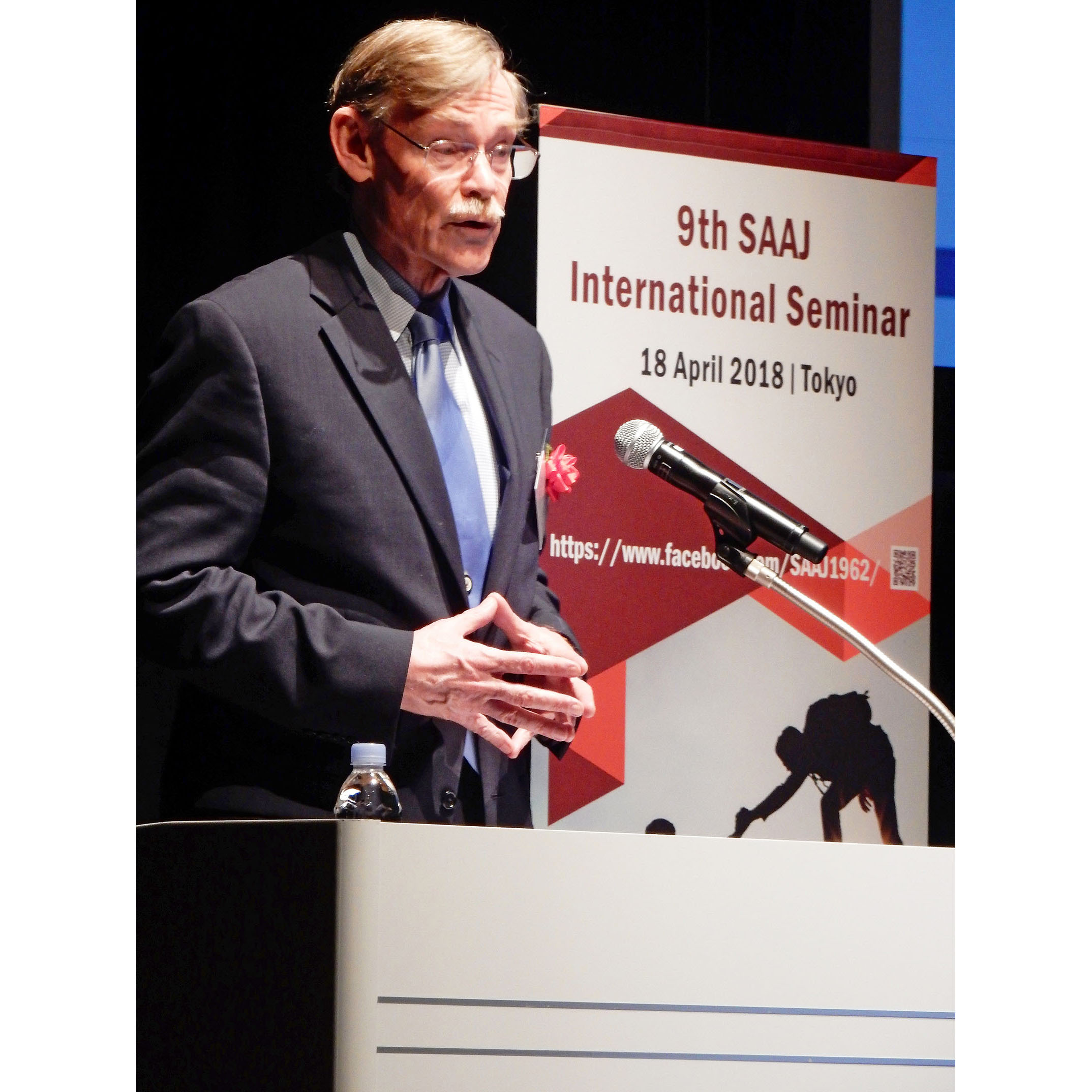

The SAAJ International Seminar has been organized by SAAJ annually since 2010 focusing on the most critical issues related to investment management. The 8th Seminar was held in Tokyo on April 18, 2018, with the main theme of “New Development of Asset Management Business Aiming at Trusted Asset Management Companies”, participated by 195 CEOs and investment professionals. Dr. Mark Anson, CIO of Commonfund, Dr. Robert B. Zoellick, Chairman of the Board, AllianceBernstein L.P., from the U.S., and other top leaders in the asset management industry from Japan gave many significant insights into issues, challenges, and opportunities toward a new growth phase of the industry.

Program

9th SAAJ International Seminar | 18 April 2018 | Tokyo, Japan

Sponsored by SAAJ

| 13:00-13:30 | Registration |

| 13:30-13:40 | Welcome and Opening Remarks Hiroyuki Shinshiba, CMA Chairman The Securities Analysts Association of Japan |

| 13:40-14:30 | Session 1 – Keynote Address Private Equity Challenges and Opportunities Mark Anson, Ph.D. CIO, Commonfund Challenges in Asset Management in Japan Norihiro Takahashi President Government Pension Investment Fund (GPIF)

|

| 14:30-15:20 | Session 2 Global Economic and Geopolitical Outlook Robert B. Zoellick, J. D. Chairman of the Board AllianceBernstein L.P. (Former President, World Bank)

|

| 15:20-15:30 | Refreshments |

| 15:30-16:20 | Session 3 A Change of Market Dynamism, How to Act? :An Asset Management Perspective Yasumasa Nishi Chairman, Farmers' pension fund (Former President & CEO Asset Management One Co., Ltd.)

|

| 16:20-16:30 | Refreshments |

| 16:30-18:20 | Session 4 – Panel Discussion What Should Asset Managers in Japan Do from Here? Panelists: Moderator:

|

| 18:20-19:30 | Networking Reception Foyer, 5th floor, Nihonbashi Mitsui Hall |

Photos